We uncover overpaid taxes in more than 87% of our reviews!

Overview

The variable nature of business environments can sometimes lead to an inefficiency in certain processes related to sales tax collection. Human errors are inevitable, and while automating procedures can simplify many day-to-day activities, it can also lead to inaccuracies that are difficult to identify. Companies conducting a high volume of transactions involving multiple vendors can easily overlook substantial disbursements, which over time, can have an impact on their bottom line.

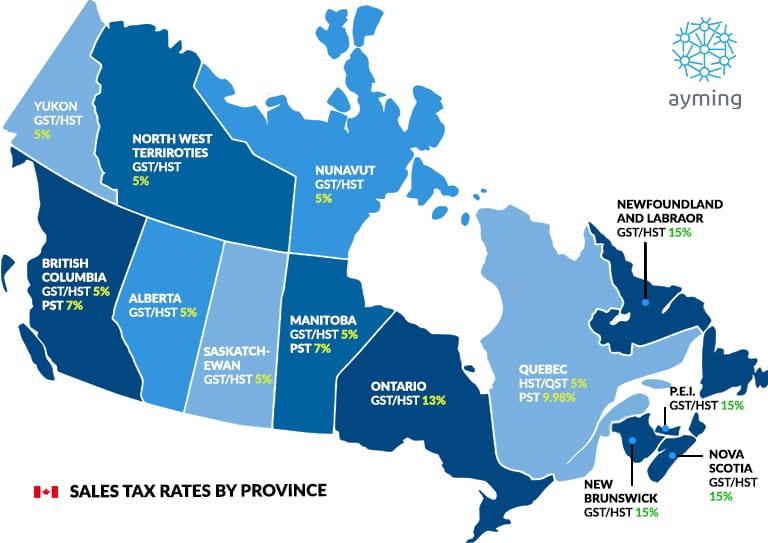

Our tax experts conduct an exhaustive review of all Canadian sales taxes (GST, HST, QST, PST). We identify all tax recovery opportunities and maximize those dollars with our industry knowledge, expertise, and proprietary tools. Our consultants have in-depth experience working with large complex organizations in all industry sectors, combining senior level financial professionals with advanced analytical techniques.

Additionally, in order to ensure that our clients benefit from future tax savings, risk reduction, and process improvements, Ayming delivers a comprehensive report at the conclusion of every sales tax review. This detailed report provides insights into taxes reviewed, realized savings, the rationale behind the refund, noted exposures, and much more. This ensures that our clients are more efficient, accurate, and compliant.

We work on a success fee basis and only get remunerated on delivering tangible results. Call us today for a free analysis of your sales tax.

Common Industry Challenges

Did you know that 87% of all reviews conducted by Ayming uncover overpaid taxes? Without regular monitoring and increased awareness of where and how overpayments can occur, companies risk making inaccurate tax payments which lead to recurrent errors and ultimately, lost profits. Many companies are often left asking the following:

- Have I overpaid on sales taxes? How do I know if I have?

- Can I increase my visibility of sales tax expenditures?

- How can I keep up with the constantly evolving legislation?

- How do I avoid repeating the same errors in the future?

- How can I implement effective changes across my organization?

Our Sales Tax Methodology

Our experts diligently work to uncover the strengths and weaknesses of your current sales tax model, allowing us to identify anomalies, address resource allocation, and any information disconnects. This process minimizes your time and internal resources with the majority of the review completed remotely (on-site visits as required). The results are delivered and documented in the 3 reports identified below:

Profit Recovery Report

Delivered upon completion of our field work, this report provides comprehensive and well-documented details of the results of our on-site review. This report will provide invoice-by-invoice schedules of all findings by type, including full documentation and any necessary steps required to recover overpayments.

Any findings that require the preparation of formal refund claims for submission to the taxation authorities will be accumulated throughout the course of the review. At the conclusion of the review, Ayming will prepare all necessary refund claims for your review, approval, and signature. No additional work is required by your staff.

Process Improvement Report

In order to assist you in benchmarking your processes, this report outlines the recoveries resulting from our review and provides an analysis of the types of anomalies identified during our review engagement. In addition, this report provides a road map with detailed recommendations for correcting the structural issues that led to said anomalies, in order to minimize them going forward.

Liability Identification Report

A major component of our commitment to assisting your business in reaching its goal of compliance is our Liability Identification Report. During the engagement, your assigned tax professional will note areas of sales tax underpayment. These exposure areas would typically be accumulated and discussed with the appropriate staff on an ongoing basis.

At the conclusion of the engagement, these exposure areas are incorporated into a confidential written report which is submitted to our primary contact, or designated advisor. The report details each area of sales tax exposure and provides specific government commentary on those issues. This report assists your staff in identifying and resolving exposure issues where necessary.

Why Ayming?

Our methodology developed over the past 35 years is the foundation for our tailored and customized approach to each new client engagement. Our tax recovery services will exceed your expectations and help you achieve superior results.

- 87% of our reviews uncover overpaid taxes.

- $105 million secured in tax recoveries annually.

- Full forensic review, at no risk to you.

- We offer a comprehensive, non-intrusive approach with minimal impact to your team.

- 35 years of experience, with operations in 15 countries globally.

- $1.5 billion in government funding and tax credits secured annually for our clients.

- $291 million secured in cost optimization annually.

- We work on a success-fee basis and only get remunerated when we deliver tangible results.

Contact us today!

One of our experts will be in touch shortly.