Innovation Employment Grant

As your trusted Funding and Tax Partner, we would like to inform you of a new fund coming soon in early January 2021. The Innovation Employment Grant (IEG) is intended to encourage economic growth in Alberta by supporting small and medium-sized businesses that invest in research and development (R&D) with a grant. The IEG provides support of up to 20% of eligible R&D expenditures incurred in Alberta; it essentially replaces Alberta’s 10% SR&ED tax credit, which had ended on December 31, 2019.

How IEG Works

- Although the IEG is called a “grant”, it will actually be delivered through Alberta’s corporate tax system.

- This grant provides support of up to $4 million dollars for annual R&D expenditures.

- It provides an 8% payment towards a corporation’s R&D spending, per year up to the minimum spend amount. Note: Spend amount is established by calculating the average R&D expenditures over previous 2 years.

- It will deliver a 20% payment towards R&D expenditures exceeding minimum spend amount.

- The focus will be on small and medium sized businesses by phasing out grants for firms with between $10 million and $50 million in taxable capital.

Start-ups in their first year of business could be eligible for a 20% return on their entire R&D expenditures from their first tax year.

What is Considered as an Eligible R&D Expenditure?

The eligible expenditures will be the same as those which qualify for the federal Scientific Research & Experimental Development (SR&ED) program. In order to qualify, the work you are conducting must be taking place in Canada and must be either basic research, applied research, or experimental development.

- Basic research: This is work carried out to advance scientific knowledge without a practical application in view. It is usually done in universities or research institutes.

- Applied research: This is also work carried out to advance scientific knowledge but, unlike basic research, it is done with a specific practical application in view.

- Experimental development: This work is carried out to achieve technological advancement. It is also by far the most common type of SR&ED work:

- It means that you are generating information or knowledge to advance your scientific or technological knowledge base – This will help you to develop new products or processes or improve existing ones

- Developing something new or improving something does not always mean that a technological advancement is being sought – Ask yourself: What technological uncertainties did I encounter when I tried to develop or improve the material, device, product or process?

The work you are claiming for S&RED must be a systematic investigation or search through experiment or analysis. This means that each approach you take to resolve your uncertainty should be a planned experiment based on an idea or a concept. You start with a problem that you cannot solve with your existing scientific or technological knowledge base. Then, you suggest new ideas for solving that problem and you test them. This will eventually lead you to increase your scientific or technological knowledge base. Generally, your work qualifies as SR&ED if you are doing a systematic investigation or search, through experiment or analysis, to advance science or technology.’

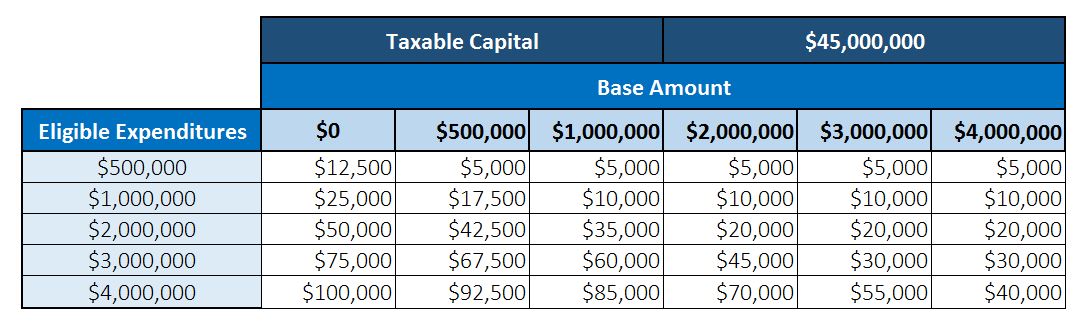

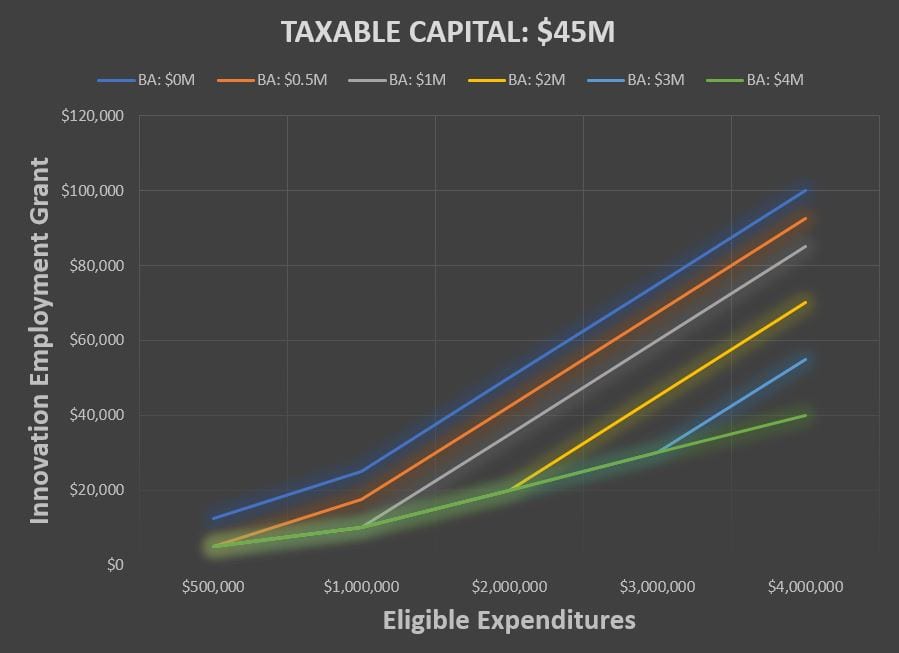

Calculations

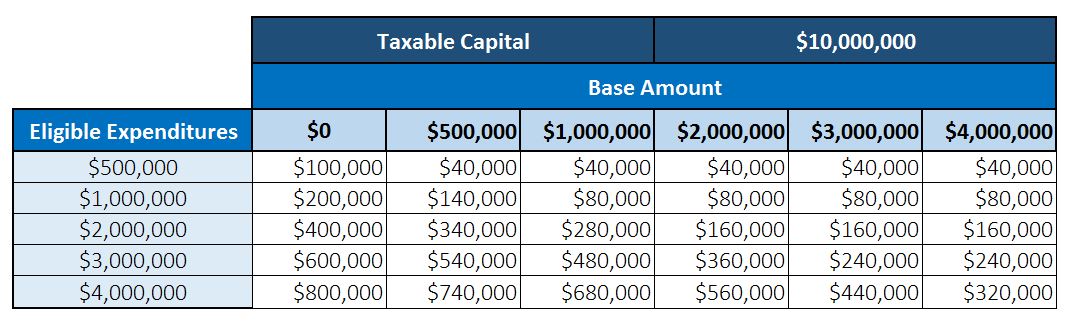

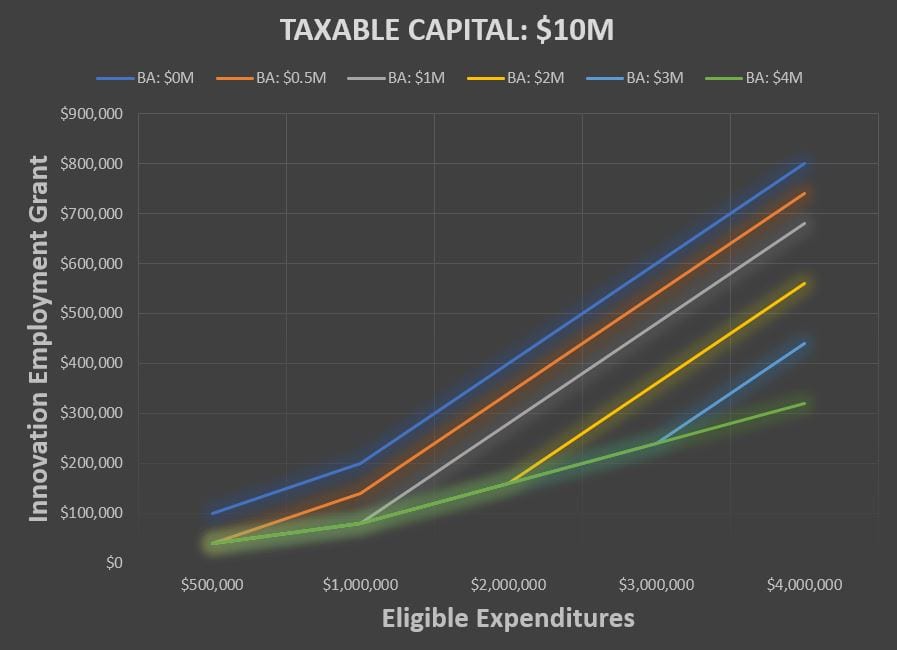

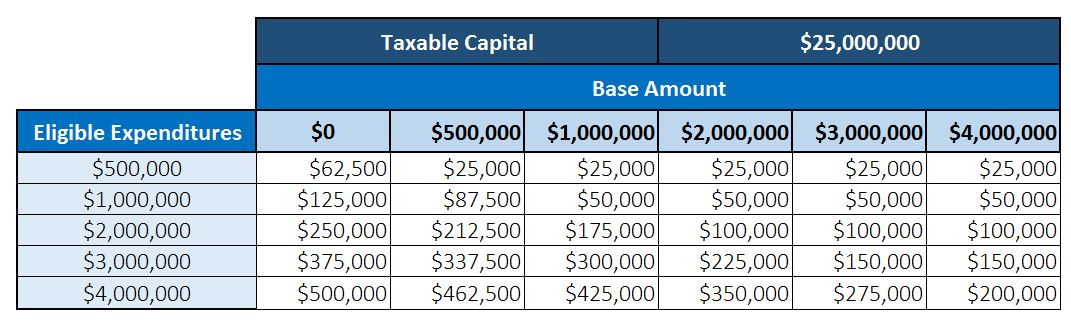

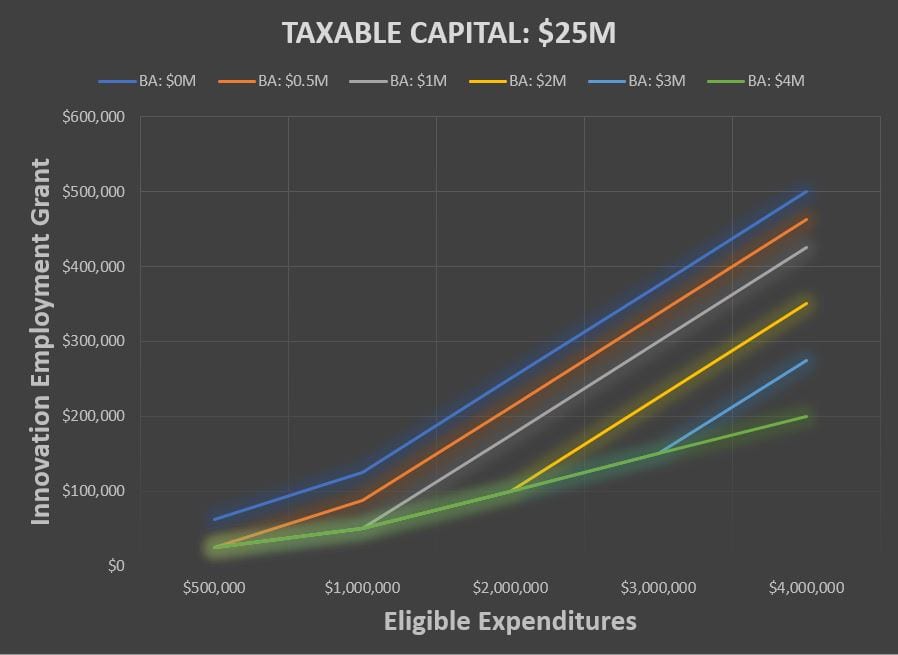

Below are some examples on how to calculate the Innovation Employment Grant based on a company’s eligible expenditures and taxable capital:

Example 1: Assuming a company has taxable capital of $10M

Example 2: Assuming a company has taxable capital of $25M

Example 3: Assuming a company has taxable capital of $45M

- Eligible Expenditures = SR&ED Expenditures in the tax year

- Base Amount = Average SR&ED expenditures over the past 2 years

- Taxable Capital = Taxable Capital for associated group

In order to determine eligibility, companies should review the criteria for the Innovation Employment Grant. Ayming is here to help you further understand the program and how it can benefit your business. This is an excellent opportunity for companies of any size, but especially start-up and early stage businesses who would be eligible for a return up to 20% on their entire R&D expenditures that year.

How Ayming Can Help

We are committed to adding value to your research and innovation by identifying eligible projects and helping you position them according to program requirements. Our proven methodology is specially tailored to each individual client and their unique needs. Development of the claim can be challenging for companies not familiar with the landscape. Our experts process over 600 claims yearly, allowing us to align your claim with program requirements and help you obtain what you’re entitled to.

Download

Speak to one of our experts today to find out how we can help you.