Revolutionizing Chain and Industrial Manufacturing: Exploring SR&ED Tax Credits for Innovations

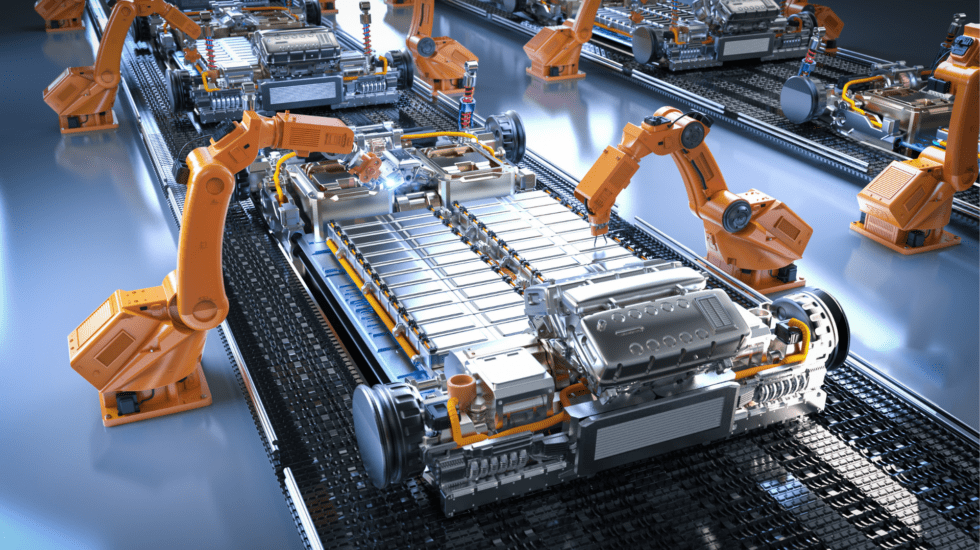

In the highly competitive world of chain and industrial manufacturing, embracing innovation is crucial for staying ahead. Technologies such as lasers, conveyors, elevators, and metal detection systems play pivotal roles in enhancing productivity and safety. The Scientific Research and Experimental Development (SR&ED) program offers significant tax incentives. Specifically, to encourage businesses to resolve technological uncertainties within these areas. Let’s examine a few examples of how SR&ED tax credits can support advancements in chain and industrial manufacturing.

Optimizing Laser Cutting Systems

Laser cutting is a critical process in many manufacturing operations. But optimizing it for various materials and thicknesses presents significant challenges. When companies invest in R&D to fine-tune laser parameters like power, speed, and focal length, they not only enhance efficiency but also the quality of the cuts. Such initiatives often qualify for SR&ED tax credits as they involve systematic experimentation to achieve the best possible outcomes across different materials.

Innovating Conveyor Belt Materials

Conveyor systems are essential for the seamless transport of goods within manufacturing facilities. Developing materials that can endure extreme temperatures and resist wear while retaining flexibility involves extensive research and testing. SR&ED supports efforts to discover or create new materials that meet these demanding industrial conditions, promoting advancements in conveyor technology.

Enhancing Elevator Safety: Chain and Industrial Manufacturing

Elevator systems in industrial settings must be impeccably safe. Researching and developing advanced sensor technologies and algorithms to detect and respond to malfunctions represents a critical area for SR&ED claims. This R&D aims to prevent accidents as well, by introducing quicker and more effective safety responses, a vital advancement in industrial manufacturing safety.

Improving Metal Detection for Quality Control

In industries where metal purity is paramount, enhancing metal detection systems to identify contaminants accurately is crucial. Investing in the development of specialized sensors and sophisticated signal processing algorithms can lead to more reliable quality control processes. Such technological innovations are often supported by SR&ED tax credits. They address the specific challenge of distinguishing minute impurities in various metal alloys.

Leveraging SR&ED for Industrial Advancements

For companies in the chain and industrial manufacturing sector, engaging in SR&ED tax credit programs not only reduces the financial risks associated with R&D but also propels technological advancements. Whether it’s refining cutting-edge laser systems, developing durable materials for conveyor belts, enhancing safety mechanisms in elevators, or advancing metal detection technology, SR&ED provides a crucial financial backbone.

To learn more about how SR&ED can support your manufacturing innovations, or to determine your eligibility for these incentives, contact us today. By documenting your research processes, experimental designs, and outcomes, we can help you maximize your potential to benefit from these tax credits.

Contact us today!

One of our experts will be in touch shortly.

No Comments