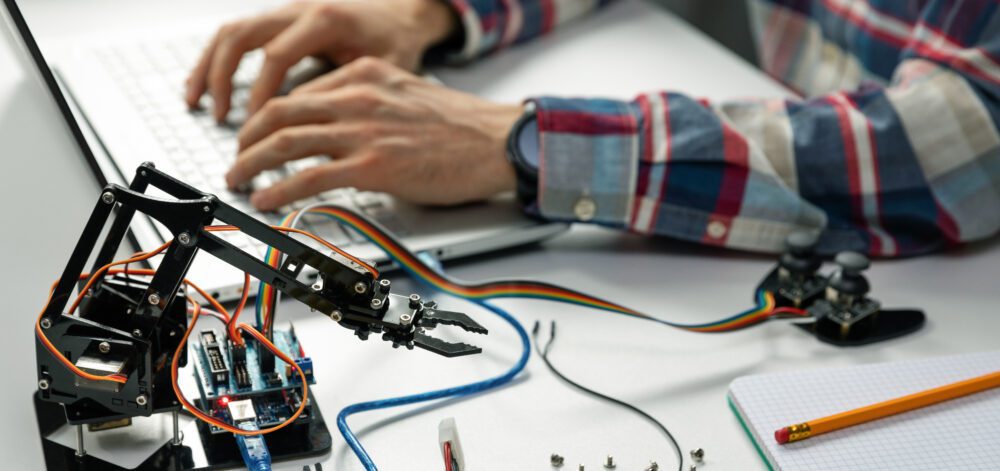

Industrial robots are an increasingly common sight on shop floors across manufacturing sectors. From raw material handling and processing operations through to final assembly, inspection, and packaging, advances in robotics technologies have accelerated the automation of many manufacturing processes.

Modern industrial robots are not only limited to applications involving heavy loads, or dirty/hazardous processes. For instance, force-sensing grippers can handle delicate parts without damage, and cobots (collaborative robots) can safely work alongside human operators without guarding, while responding to touch or proximity without causing injury.

Current challenges

As manufacturers strive to reduce cycle times and improve repeatability and reliability, engineers and designers must innovate constantly. Delta robots, for example, demand lightweight end effectors to ensure the high-speed performance they are selected for, but off-the-shelf tooling is regularly unsuited to the specific application; ensuring tooling weight and size constraints are satisfied while providing the required functionality can take significant development time. Repeatable part presentation for accurate robotic picking can also present challenges – conveyors and automated nests/fixturing can become their own separate development projects.

Machine vision systems, similarly, have come a long way and present new opportunities in affordable automated inspection or recognition, but successful implementation is often difficult and can lead to advancements in lighting or datum feature design.

Retrofitting existing production lines can also lead to unexpected demands on controls systems and data management in pursuit of computational efficiencies when dealing with, for example, dimensional variability in existing manufacturing infrastructure that would otherwise be managed by human operators.

Strengthening SR&ED eligibility

Our experts’ understanding of manufacturing requirements and technologies, along with our academic backgrounds, help us reinforce the eligibility of your SR&ED claims in the eyes of the CRA by emphasizing the scientific fundamentals behind your project targets and constraints. We leverage our deep knowledge to ask your project leads the right questions and ensure we clearly and accurately articulate your technological uncertainty in the context of limitations in your existing knowledge or technology. Were there repeatability issues in ensuring alignment of the circular parts in your fixture? Did the processing temperature affect your sensors and data lines? These technological uncertainties, which the CRA defines as the starting point of your SR&ED work, are a key part of justifying why the work was done and, crucially, why it qualifies as SR&ED.

We extend that same fundamentals-based approach to presenting your technological advancements and connecting them to your company’s broader operations to drive home the significance of your work. Did your advancement in material handling lead to new design best-practices for gripper wear plates? Were designs for part presence sensor systems on other polymer product processing lines updated based on your findings? As in the case of your technological uncertainties, the advancements you sought through your research and experimentation are an important part of determining SR&ED eligibility, and our experts help you distill your results into concise, compelling project descriptions.

In the event of an audit, Ayming’s extensive in-house experience with SR&ED, and the CRA as a whole, leaves us particularly well-equipped to support you in defending your claim. Responding to an RFI – the CRA’s formal Request for Information in support of a claim under review – can be a stressful, hectic process. Simply tracking down your notes, spreadsheets, drawings, and more takes enough time. Our experts help you by preparing RFI responses with your supporting documentation and conducting prep sessions with your staff in the lead-up to the audit meeting.

Optimizing SR&ED claim maximization: Ayming’s in-depth approach

By conducting plant tours and technical interview sessions with your development teams, Ayming’s experts build a thorough understanding of your internal competencies, technical capabilities, and manufacturing infrastructure. The consultant managing your file nurtures the relationship with your stakeholders over the years, learning to navigate your operation and maximizing efficiency in info collection – we want your staff to spend less time on claim preparation and more time doing their jobs. Combined with our own industrial experience and knowledge of process development, we strive to drill down into your development efforts to uncover all claimable facets of your projects and maximize your claim size. We aim to account for inputs from all teams and subcontractors involved in your projects, from process simulations investigating takt time through to external laboratory analysis on materials for new tooling designs. We also take the time to comb through your materials expenditures to capture all costs associated with your prototyping and experimentation activities since, as we all know too well, a null result is still a result.

Written by Thomas Zabev,

SR&ED Consultant at Ayming

Find out more about the SR&ED tax credit program and how we can help you get started.

Contact us today!

One of our experts will be in touch shortly.

No Comments